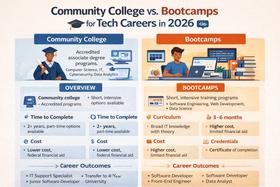

Attending a community college often has the reputation of being an affordable gateway to higher education and workforce training. But the truth is more nuanced. In 2025, the turn-key cost of enrolling in a two-year institution still conceals a range of “hidden” expenses—books, fees, housing, transportation, child care—that significantly affect student success. For parents, students and educators, gaining full visibility into these costs is critical.

This updated article draws from the original structure on BoardingSchoolReview’s partner site Community College Review but refreshes the data, policy context and practical advice to reflect 2025 realities.

1. Tuition and fees: still low but rising for some

One of the enduring advantages of community colleges is their relatively modest tuition and fees compared with four-year institutions. According to the U.S. Department of Education, in 2021-22 the average in-district tuition for a full-time student at a public two-year college was $3,307 with required fees of $671.

However, more recent estimates show that tuition and fees alone do not paint the full picture.

A 2025 breakdown from EducationData reports the average tuition and fees for a full-time in-district student at a community college at about $3,890 annually (in-district) and roughly $9,250 for out-of-state students. Education Data Initiative Meanwhile, another source estimates the average cost of attendance (tuition + fees + living costs) for a community college student in 2025 is about $7,780 per year.

What this means: yes, tuition remains comparatively affordable, but families should be