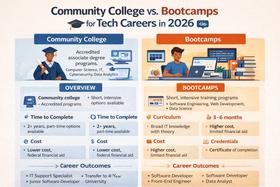

Community College vs. Private College Costs: What Families Must Weigh

When families begin planning for higher education, one of the most consequential decisions is cost. In 2025, rising tuition, living expenses, and the complexity of financial aid make it more important than ever to compare apples to apples. This article lays out the key components and trade-offs families should analyze when comparing community college costs to private college costs.

1. Understanding the Sticker Price: What Are You Paying?

Community College (Public 2-Year)

For the 2024–25 academic year, the average tuition and fees at U.S. public community colleges are approximately $4,050 annually. Center for American Progress

Some sources estimate the in-district rate just over $3,780, while out-of-state tuition averages around $8,784. Community College Review

Community colleges often price tuition at only ~35% of what in-state public four-year institutions charge. AACC

According to CommunityCollegeReview, one estimate for 2025 shows in-state community college tuition around $5,238, with out-of-state at $8,895. Community College Review

Private (Nonprofit Four-Year)

The average private nonprofit college’s sticker tuition, fees, room and board hover around $38,421 + other expenses = ~$58,628/year in many instances. Education Data Initiative

Some recent analyses show private college tuition sticker prices reaching $43,350 for 2024–25.