Hidden Costs When Starting at Community College: What Private-School Families Should Plan

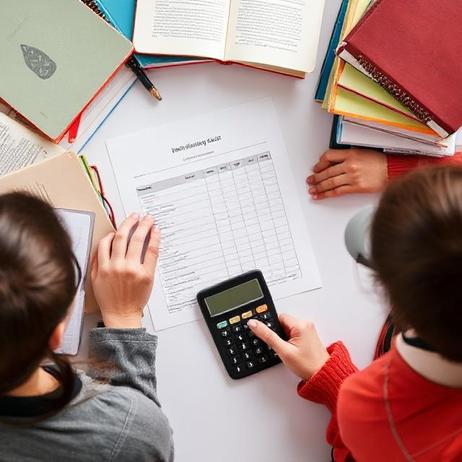

For families accustomed to private-school tuition and fully itemised cost expectations, the transition to a two-year public college environment may appear straightforward. Lower sticker tuition at a community college is often the headline; however, the hidden costs at community college can accumulate rapidly. Private-school families should be especially prepared, as the budgeting mindset formed in secondary education won’t always translate directly. Below we unpack key cost areas, provide updated 2025 context, and offer strategic action points to help parents, students and educators plan smartly.

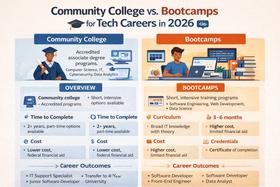

1. Why Community College Looks Affordable But Isn’t Always Low-Cost

Community colleges often advertise significantly reduced tuition compared to four-year institutions. But as recent analysis shows, tuition may represent only a fraction of the full cost of attendance. For example, a summary for 2025 points out that even when tuition is low, housing and food often account for over 50 percent of a student’s budget. Community College Review

One recent dataset puts average total cost of attendance at a two-year institution around $7,780 per year (2025 estimate) although that number masks variation in living situation, location, program type and fees.

For private-school families who may already operate on a full budget for boarding or day costs, the shift to community college can carry unexpected costs unless carefully forecasted.

2. Major Hidden Cost Categories at Community College

Below is