If you are one of the millions of college graduates struggling with student loan debt, you might be considering an option to refinance. Even though community college is often more affordable than a traditional four-year university, school is never cheap. Depending on your debt and how much you can pay, you might be able to consolidate and/or refinance your loans to make your payments more affordable – keep reading to learn more.

Save Money by Refinancing Your Student Loans

Refinancing your loans means that you will be repaying your existing debt by taking on a new loan with new terms, often from a new creditor. Two of the most common options for refinancing your student loans are private loan refinancing and federal loan consolidation. Again, it depends on the type of loans you have and how much debt you have as well. If you can refinance through a private lender, you might be able to get a lower interest rate. At the same time, federal loan consolidation is usually a good option for people who are looking to simplify the repayment process by lumping multiple loans into a single payment plan. Loan consolidation may or may not give you a better interest rate.

If you’re thinking about refinancing your community college student loans, there are a few questions you should ask yourself first:

- Why are you refinancing?

- What are your options?

- What rate can I get?

The first question about why you are refinancing is very important – your goals will help you choose the lender that best fits your needs. Ask yourself whether you’re looking to get a better interest rate or if you want to consolidate multiple loans into a single payment. Another reason you might be refinancing is to switch to a company with better support options or you might be looking to get a new loan to remove a cosigner from your account.

After determining your reasons for refinancing, you should consider your options and consider the repercussions of each choice. Refinancing or consolidating federal loans into a private loan could get you a better interest rate. Still, it might also mean giving up certain privileges, such as deferment or federal loan forgiveness. Take your time to research your options and consider the pros and cons of each one before you make your choice. You should also take a close look at the interest rates you might be able to get. Remember that some refinancing options might offer a low upfront rate, which could change over time, so look for “variable rate” loan options. The rate you get may depend on the lending term – shorter terms usually have lower rates.

This video offers a list of sites to refinance your student loans.

What Are Your Options?

Though student loan debt has become an epidemic in this country, many options exist for refinancing and debt consolidation. Because there are so many options, however, it makes it tricky to choose the company that best suits your needs – this is why it is so important to determine your needs upfront so you can easily narrow your search. Once you know what you are looking for, you can search the internet for different lenders who might meet your needs. Here are some of the lenders who are currently offering refinancing options:

- Citizens Bank – Take out $10k to $150k with a fixed rate between 3.74% and 8.24% or a variable rate between 2.6% and 8.39%.

- College Ave – Take out $5k to $250k with a fixed rate between 4.75% and 7.35% or a variable rate between 3.0% and 6.25%.

- iHelp – Take out $10k to $150k with a fixed rate between 4.65% and 8.84% or a variable rate between 3.58% and 9.47%.

- CommonBond – Take out $10k to $500k with a fixed rate between 3.37% and 6.74% or a variable rate between 2.56% and 6.48%.

- LendKey – Take out $7.5k to $125k with a fixed rate between 3.25% and 7.26% or a variable rate between 2.43% and 5.97%.

- Purefy- Take out $7.5k to $150k with a fixed rate between 3.5% and 8.24% or a variable rate between 2.11% and 7.4%.

- SoFi - Take out $5k or more with a fixed rate between 3.38% and 6.74% or a variable rate between 2.58% and 6.5%.

If you do your own research, you might come up with more options to add to this list. Just remember that you need to read the fine print and consider all of the tiny details before you make a big decision like refinancing your student loans.

This video describes one person's experience refinancing his student loans through Commonbond.com.

Tips for Reducing Debt While Still in School

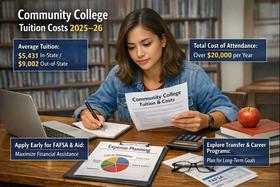

If you are still in college or haven’t started yet, you can get a jump on your student loans by following some simple tips to reduce your debt while you’re still in school. Here are some things you can do:

- Take some time to save up before you enter college – this might mean taking a year or two off after high school graduation, but it could help you leave school with less debt.

- Choose your college carefully – community colleges are usually more affordable than state schools and universities, but costs vary from one school to another.

- Take advantage of scholarships and aid by filling out your FAFSA – the earlier you fill out the FAFSA, the more aid you are likely to get, and it determines your eligibility for work-study in school.

- Look into scholarships offered by your school of choice – determine whether the scholarships are need-based or merit-based and find out how to apply.

- Don’t forget about grants – many state governments and organizations offer college students scholarships that you don’t have to pay back.

- Be smart about scheduling your classes – work closely with your academic advisor to ensure you are taking all the classes you need and nothing you don’t need if it means paying extra tuition.

- Try to graduate early – many schools charge by the semester, so if you can cram in a few extra classes and graduate one semester (or even a whole year) early, you could save thousands of dollars.

- Take out federal loans before private loans – federal loans are usually available at a lower interest rate than private loans. You might also be able to defer the interest or the whole loan while in school.

- Use your loan money appropriately – only take out as much as you need in loans and avoid using them for things you don’t really need for your education.

- Create a budget and stick to it – the best way to be smart with your money is to know exactly how you spend it and to keep a tight grip on your purse strings.

This video offers eight ways to lower or eliminate your student loan debt payment.

For many people, student loan debt is unavoidable – it is the only way that they can pay for college. However, if you are struggling with your student loan debt, there might be a light at the end of the tunnel. By refinancing or consolidating your loans, you might score a lower payment or a lower interest rate, which could help keep your head above water. Consider our tips and advice provided above, but be sure to do your own research as well to find the option that is best for you.

Questions? Contact us on Facebook. @communitycollegereview