Community colleges are known for their low-cost education options that help students with limited funds get the training they need to find good jobs after graduation. However, many hopeful students realize that even community college can become an "impossible dream" once they discover federal loans are not available for many of these institutions.

A recent study from the Institute for College Access and Success found that more than one million students across 31 states cannot access the federal loans they need to make a college education a reality. We will explore the reasons behind this reality and how it impacts the ability of adults to get the education and training they need today.

What Federal Loans Can Do

The Institute for College Access and Success conducted this study through their initiative, Project on Student Debt, which is committed to helping make college more available and affordable to students of all backgrounds. The study states that community colleges serve various purposes, from awarding associate degrees and certificates to providing workforce training and lifelong learning opportunities for students of all ages. These schools are designed to serve students of all backgrounds and income levels, ensuring everyone in this country has access to the necessary training to land good jobs after graduation. Community colleges are currently educating 40 percent of all undergraduate students nationwide.

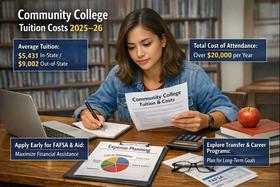

The low tuition and fee rates have historically made these institutions more affordable than other schools of higher learning. However, the study also notes that when those expenses are combined with the cost of books, transportation, and living, the price of education through community college quickly rises to levels comparable to other universities. Federal student loans can help make the cost of education more affordable to students. Still, the study found that community college students are much less likely to have this option available to them than individuals attending four-year colleges and universities.

Financial experts across the board agree that federal loans should be a first resort when financing an education, above credit cards, or other types of consumer debt. Federal student loans offer many advantages over other lending options, including low fixed interest rates, flexible repayment plans, and generous forgiveness programs. Consumer protections are also abundant on federal student loans, offering graduates options for unemployment, military service, death, and disability. When students do not have access to these loans, they must resort to other types of borrowing that leave them more vulnerable to economic difficulties after college.

This video looks at issues with student loans.

What the Study Found

According to the study, nine percent of all community college students nationwide cannot access student loans. In some states, the number without access rises to more than half of all community college students. A report at Reuters provided additional data about the study:

- As many as 16.4 percent of African-American students and 18.5 percent of Native-American students in community colleges lack access to federal loans nationwide.

- North Carolina features the most community college students without access to federal loans, at 57 percent of their entire community college population.

- Default rates on federal student loans across the country currently stand at about seven percent. However, default rates for community college students, who often come from lower-income backgrounds, could be somewhat higher than the national average.

Debbie Cochrane, program director at the Institute for College Access and Success, told Reuters about the findings, "Federal student loans should always be considered before relying on credit cards to get by or taking out a private student loan or resorting to payday lenders. Federal financial aid programs, both grants and loans, are there to make sure that students from all backgrounds can afford to cover college costs. When colleges opt out of the loan program and don't make that option available to students, it undermines the goal of the program: making college more affordable."

This video offers suggestions for reducing student debt.

Why Colleges Don't Allow Federal Aid

There are several reasons why community colleges are hesitant to make federal funding available to their student bodies. According to a report in the Rocky Mount Telegram, some schools fear losing all of their federal aid if students do not repay their loans on time. Some school presidents also don't believe that students really need the money since tuition rates for community colleges are already meager.

Martin Nadelman, president of Alamance Community College, told the Telegram, "I feel that if we were to participate [in the federal loan program], there would be students that would borrow money for purposes other than education. I think we're trying to help them do the right thing." Many of these community colleges offer various grants and scholarships to students through affiliated foundations rather than the federal government. However, not everyone agrees that the college should make the financial decisions for the students.

Rick Glazier, a North Carolina House member, told the Telegram, "Nothing suggested to me that students in these other colleges were any less capable of making decisions about their life, about what debt they wanted to incur, or that they were any less advantaged or disadvantaged in gaining jobs when they left college. It's not about what's best for the colleges, but what's best for the student."

It appears that community colleges will continue to debate the issue of federal student aid as more schools grapple with the best approach to paying for higher education. In the meantime, students around the country wait anxiously to find out whether they can afford the education and training they desperately need for the jobs they want.

Questions? Contact us on Facebook. @communitycollegereview