Save $80K by First Attending Community College (Updated 2025)

Many students and families wonder whether bypassing a four-year university for a community college first can really save tens of thousands of dollars. In 2025, rising tuition, new financial aid programs, and improved transfer systems make the community college route more viable—and potentially more rewarding—than ever. This guide shows how to save up to (or more than) $80,000, what you need to know, and whether this path fits your long-term educational and career goals.

Why the Savings Can Be That High

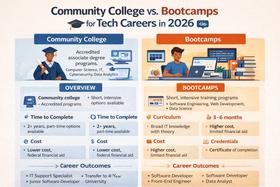

To understand how saving $80,000 is possible, it helps to break down the cost differences between community college and four-year institutions.

According to Community College Review’s 2025 tuition data, in-state community college tuition averages about US$5,099/year; out-of-state tuition is ~$8,784. Community College Review

By contrast, the average cost of attendance at a public in-state four-year college (tuition, fees, room, board, and related expenses) is around $27,000/year, or more depending on the state. Education Data Initiative

Many students also incur additional costs: housing, food, transportation, books, etc. Over four years at a four-year university, those add up substantially.

If a student spends the first two years at a community college (paying in-district rates, living at home or off-campus cheaply), then transfers to a four-year school for the final two years, savings can easily approach US$60,000-$100,000, depending on the four-year school’s costs, housing expenses, state vs. out-of-state tuition, and whether aid applies.

Updated Data: