Average Community College Tuition Cost Update 2026

Community colleges remain one of the most affordable pathways to higher education in the United States, offering a lower‑cost alternative to four‑year universities while providing career training, transfer opportunities, and flexible scheduling. For parents and students planning ahead for the 2025–26 academic cycle, it is vital to understand what tuition costs look like today, how they compare with past years, and how non‑tuition expenses and financial planning affect overall affordability.

Current National Tuition Averages

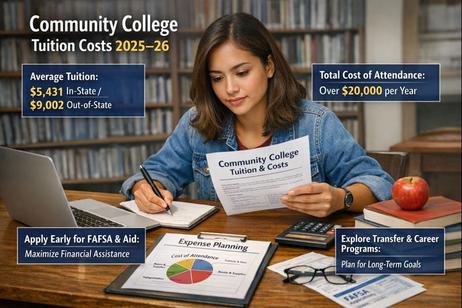

For the 2025–26 academic year, recent data indicate that public community college tuition averages approximately $5,431 per year for in‑state students and $9,002 per year for out‑of‑state students. This reflects slight year‑to‑year increases at many institutions but continues to be significantly lower than tuition at four‑year colleges and universities.

These figures are consistent with broader tuition reporting that places community college tuition in the $5,000–$8,800 range nationally, depending on residency status and institutional policies.

Understanding Tuition Variability by State and Residency

One key characteristic of community college costs is wide state variation. In states like California and New Mexico, in‑district tuition can be as low as $1,440–$2,250 per year, whereas in high‑cost states such as Vermont, published tuition can approach $8,900 annually.

Residency also plays a major role. Students qualifying for in‑district or in‑state tuition pay significantly less than out‑of‑state or out‑district students, who often see tuition costs nearly double the in‑district rate.

As an example, the average tuition and fees at community colleges in Illinois — a state with higher than average costs — is about $4,813 for full‑time, in‑district students, while public universities in the same state remain far more expensive.

Tuition vs. Cost of Attendance

Tuition and mandatory fees represent only one piece of the financial picture. Families should plan for additional expenses that significantly affect total cost: books and supplies, transportation, housing, food, and other living costs can double or triple the base tuition amount. According to budgeting data, the overall cost of attendance for community college students can exceed $20,000 per year when all components are included.

For many students, living at home can substantially lower overall expenses. However, students relocating for school or needing to cover room and board should incorporate those additional costs early in their financial planning.

Trend Overview: Tuition Changes and Cost Drivers

Tuition increases at community colleges have remained relatively modest compared with four‑year institutions. Published reports show a gradual rise, typically in the low single digits annually, reflecting inflation pressures and evolving state funding levels. However, the sticker price often overstates the net cost that many families actually pay after financial aid, scholarships, and state‑based grant programs are applied.

Recent tuition pricing trends from the College Board indicate average in‑district tuition increased by approximately 2.7% from the previous year, with wide state‑by‑state differences.

At the same time, national discussions continue around tuition‑free community college initiatives in some states, which could dramatically affect affordability if enacted. For example, proposals in Massachusetts have sought to cover tuition, fees, and supplemental stipends for eligible students, though legislative approval remains uncertain.

Admissions Timing and Planning for Costs

For families preparing for community college, timing matters. Most community colleges enroll students on a rolling or multiple‑term basis, with start dates in fall, spring, and often summer. High‑demand programs may have earlier deadlines or limited seating, making early application critical. It is best to begin planning six to nine months before your intended start date, gathering necessary transcripts and financial information, and completing the Free Application for Federal Student Aid (FAFSA) as soon as it opens each year.

FAFSA and state financial aid programs can reduce net tuition significantly, particularly for students from low‑ and middle‑income families. Some state grant programs cover all tuition after federal aid is applied, lowering out‑of‑pocket costs even further.

Financial Aid, Scholarships, and Net Price

Understanding the difference between published tuition and net price is essential. Many community college students receive financial support that covers most or all of their tuition. Federal Pell Grants, state awards, and institutional scholarships can cut costs dramatically, often resulting in much lower net costs than the published rates suggest.

For example, data from financial aid reports show that over half of community college students receive some form of aid, with a substantial portion receiving enough grant funding to cover tuition entirely.

Parents and students should explore institutional aid, state programs, and external scholarships well before the start of the academic year to maximize financial support opportunities.

Career Training, Transfer Options, and Return on Investment

Community colleges serve varied student goals. Many students pursue workforce certificates or associate degrees in fields aligned with current job growth, such as health care, information technology, or advanced manufacturing. Others use community college as a cost‑saving pathway toward a four‑year bachelor’s degree by transferring credits to universities upon completion of their initial coursework.

Choosing programs with strong transfer agreements can increase the return on investment, particularly when paired with aggressive financial planning and early career exploration.

Key Takeaways for Families

Tuition remains affordable compared with four‑year colleges, averaging around $5,400 for in‑state students and $9,000 for out‑of‑state students in the 2025–26 cycle.

Residency and state of attendance affect costs, so research local community college rates early.

Total cost of attendance is higher than published tuition, including books, housing, and transportation.

Apply early for FAFSA and financial aid to reduce net costs and maximize scholarships.

Explore transfer agreements and career pathways to enhance long‑term value.