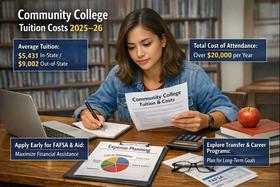

Transfer Pathways in 2025-26: What Students at Community Colleges Need to Know to Get Into 4-Year Universities

Transferring from a community college to a four-year university continues to be one of the most economical and accessible routes to a bachelor’s degree. But in 2025-26, this process is evolving. New policies, shifting admissions thresholds, expanded articulation agreements, and equity reforms are reshaping what students, parents, and educators need to know. Below is a comprehensive guide to navigating transfer pathways in 2025-26—with data, examples, and expert commentary.

What’s Changed in 2025-26

| Area | Key Change or Trend | Implication for Community College Students |

|---|---|---|

| More Formal Articulation Agreements | Institutions like Webster University are adding dozens of new “articulation agreements” allowing favorable transfer into specific programs. ( | Students in partner colleges can plan specific majors earlier, saving time and money. |

| Tighter Admission Criteria for Transfer Students | Some institutions updated transfer GPA thresholds—for example, University of Georgia raised its cutoffs for students with 30-59 and 60+ transfer hour. | Students must maintain stronger GPAs and align coursework earlier to meet eligibility. |

| Transparency & Statewide Transfer Guides | States like North Carolina publish annual transfer guides; systems like UNLV (Nevada System of Higher Education) also update their articulation catalogs for majors. | Students can now clearly see which courses will transfer, making planning more predictable. |

| Equity & Outcomes Focus | Research highlights that while transfers boost bachelor’s degree completion, earnings gains are not always strong unless transfer pathways are well-aligned and support is in place. | Students and advocates must pay attention not just to transfer, but to long-term outcomes, |