2025 Community College Tuition Trends: What Parents Should Know

As parents and guardians help their students prepare for post-secondary education, understanding tuition trends at community colleges has never been more important. In 2025, the landscape for two-year institutions is evolving: tuition remains relatively modest compared to four-year colleges, but cost-pressures, changing student demographics, and institutional responses are shaping what families should expect. This article provides a clear, up-to-date look at community college tuition trends, how they impact families, and actionable advice for navigating the choices.

Why community college tuition matters

For many families, enrolling at a community college is a practical first step toward a degree, certificate, or transfer to a four-year university. Because community colleges often allow full-time or part-time attendance, local commuting, and lower tuition, they can reduce the total cost of post-secondary education.

Key reasons tuition trends matter:

Tuition affects upfront affordability and influences student debt.

Tuition growth (or the lack thereof) signals how accessible education remains.

Tuition combined with living, transportation, and books gives a fuller cost picture.

Awareness of tuition trends allows families to budget, apply for aid, and plan alternatives.

In short: understanding what tuition is doing at community colleges helps parents and students make informed decisions.

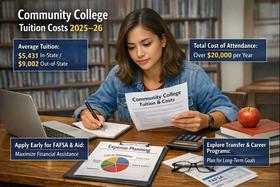

Current national tuition trends for community colleges (2024–25 & 2025)

What the numbers