Each year, millions of students graduate from high school and move on to higher education. While 4-year colleges and universities may be the more traditional option, community college works for many students. If you are thinking about enrolling in community college, take the time to learn about this option from every angle.

In this article, you will learn about the pros and cons of community college to help you make your choice. If you do decide that community college is right for you, you’ll also receive tips for taking control of your community college education so you can graduate with the best chance for success upon entering the “real world”.

Is Community College Right for You?

If you think that community college could be the right choice for you, you would be wise to learn about the pros and cons of making this choice. Community college is an excellent alternative to four-year colleges and universities, but it isn’t the right decision for everyone. Here is a list of advantages that may be associated with community college:

- Many community colleges offer smaller class sizes which could mean more personalized attention and instruction from your teachers.

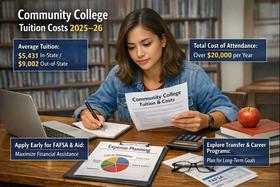

- Community college is generally much less expensive than traditional 4-year schools, especially if you continue to live at home.

- Many community colleges offer online classes and night classes, making it a more practical option for people who are working full-time or who have a family.

- You may be able to complete your core classes at a fraction